Content Category

Content businesses use a variety of business models, such as affiliate, display advertising, and even lead generation. The demand for content businesses is still high, and in 2020, we sold more of them than we did in both 2019 and 2018.

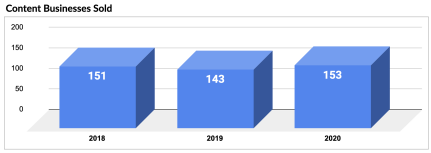

In 2020, we sold 153 content businesses, as compared to 2019, where we sold 143 and 2018, where we sold 151. While the increase in content business sales is a small trend, it is consistent with what we’ve seen for years.

Content businesses are highly desirable for buyers at all levels and phases of their investing careers. The 153 businesses sold in 2020 represented 51.34% of all deals transacted on the marketplace. We sold more content businesses than any other business model, and we remain the standout leader in this model, as we have been for years.

One of the major reasons why content businesses are so popular is their ease of management; there is no need to fulfil product orders or perform customer service. This obviously makes this model more attractive to buyers just starting out who may feel overwhelmed with all the moving parts involved with, say, a traditional ecommerce store. Content businesses also offer a way for entrepreneurs to build out an addressable audience.

Since most content sites drive traffic through organic SEO methods, this is traffic that requires little to no day-to-day management as opposed to something like paid ads. SEO traffic tends to convert the highest to relevant offers as well when compared to other traffic channels, which makes content sites a prime place to start collecting email addresses.

Savvy entrepreneurs can then leverage that list for a variety of email marketing strategies, promoting more private affiliate offers, or they can even leverage the addressable audience to grow a product-based business like an FBA store or even a SaaS business if it makes sense for the niche the content site is operating in.

Quick Snapshot

Here’s a comparison of a variety of metrics from 2018 to 2020:

Let’s take a deeper look.

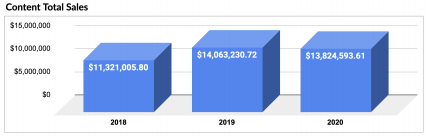

Here’s a breakdown of the number of brokered content businesses from 2018 to 2020 and the total sales:

Here’s the average list price from 2018 to 2020:

The average list price for content businesses was $101,466.30, which is incredibly close to the average sales price of $94,419.02. Brokering content sites represented $13,824,593.61 in total revenue for our M&A brokerage, and represents a huge chunk of the market in general, allowing us to give you solid insight into how buyers and sellers are interacting with this asset class.

The average list and sales price both increased by 4% in 2020 as compared to 2019. This metric becomes far more dramatic when you compare the brokered sites in 2020 with 2018, however.

There is a 21% increase in the average list price and a 23% increase in the average sales price in 2020 as compared to 2018.

That is huge.

In just two short years, content sites saw a gigantic jump in their actual values. Based on the increase from 2019 to 2020, we might be reaching the top pricing the market will allow for these businesses considering that year-over-year growth.

It is clear that buyer demand rose in 2020, so there may still be room for an increase in price, although the growth will likely be more akin to that between 2019 and 2020 than 2018 and 2020.

The increase in list and sales prices are also consistent with the increase in the actual list and sales multiples. In 2020, the average list multiple for content business was 33.8x and the average sales price multiple was 31.6x.

This represents a 6% increase in list and sales multiples from 2019 and a 15% increase from 2018.

So what happened that made these multiples and valuations grow?

It comes down a variety of different factors happening all at once, including:

- An increase in online shopping in 2020, leading to higher profits for online businesses all around

- An increase in buyer demand for online businesses

- Investors from other asset classes, such as real estate, coming to acquire online businesses

- Larger content sites being sold that are positioned as the “go to” brand in their niche or positioned to become that

- Huge increase to actual content and site quality as more grey hat strategies, such as PBN or low-cost content, start disappearing in favor of more white hat SEO strategies and larger emphasis on expert-driven content

Apart from the drastic increase in valuations for content sites, perhaps one of the more exciting metrics from a seller perspective is the actual number of days it took content sites to sell on the marketplace. In 2020, the average time it took for content sites to sell was just 30 days.

Here is a breakdown of the average number of days on the market from 2018 to 2020:

It took content businesses 4% less time to sell on the market in 2020 than it took in 2019, though the average days on the market was actually 37% higher in 2020 than it was in 2018.

How could this be? This is likely due to the increase in average sales prices.

The average sales price in 2018 was $76,780.93, as compared to $94,419.02 in 2020. While the increase seems small on the surface, a big portion of this increase in average list price comes from much larger multiple six-figure businesses being listed on the marketplace.

Typically, as the size of the business grows, the longer it will take to sell.

Back in 2018, we sold far fewer high six-figure businesses; in 2019 and 2020, we had a small flood of these larger businesses coming to the marketplace. This means the decrease in days on market from 2019 to 2020 is actually a more reliable indicator of increased speed than comparing 2020 to 2018.

All of this is fantastic news for sellers, and it goes back to the trend identified in this report that we’re entering a true seller’s market.

Right now, if you are the owner of a content business, it is one of the best times to make a profitable exit.

Content businesses remain a staple for both buyers and sellers. They’re an attractive business model that is low maintenance with a very high profit margin. Let’s take another look at the overall growth of this model in the sheer sales volumes on our marketplace from 2018 to 2020:

In 2020, we produced $13,824,593.61, which is very close to the 2019 number of $14,063,230.72.

In the last two years, the market overall has stabilized around the $14 million mark, but that is a sizable increase from 2018, when content business sales represented $11,321,005.80 in business sales on the marketplace.

Despite this huge revenue in 2020 and the fact that over 50% of the businesses we sold were content businesses, they represent only 16.93% of our actual sales in 2020.

This is the lowest percentage of the total sales on our marketplace that content sites have had on our marketplace. However, this is not a significant cause for concern for buyers and sellers in this space. As we mentioned above, the actual revenue amount for these transactions is stable if not growing slightly. The reason why content sites represent a much smaller percentage of our

marketplace in 2020 has nothing to do with the quantity listed, but rather the explosion of FBA businesses being sold, something we’ll discuss further later.

The trends indicate that the content sites being sold are bigger, more profitable, and better equipped in terms of branding than they were in previous years. We believe that these trends are eventually going to lead to content sites that are more rounded in terms of traffic diversity and even revenue diversity. There will likely be brand builders that start incorporating email in a larger and more impactful way. Once email marketing becomes more popular in this business model, it is likely that other traffic channels will start getting tested since the email list will ultimately increase the lifetime value of each visitor, which will allow site owners to build out more expensive traffic channels.

Regardless, it is a certainty that content businesses will remain one of the most popular online business models for both sellers and buyers. We don’t see this changing anytime soon, even with other business models exploding in popularity.

As the market grows, with more people than ever before investing in digital assets, content sites will remain a staple of the industry.

Download the Empire Flippers State of the Industry Report HERE